P3 Accounting Llc Fundamentals Explained

Wiki Article

The Buzz on P3 Accounting Llc

Table of ContentsP3 Accounting Llc for BeginnersSome Ideas on P3 Accounting Llc You Need To KnowAll About P3 Accounting LlcThe Greatest Guide To P3 Accounting LlcP3 Accounting Llc Things To Know Before You Buy

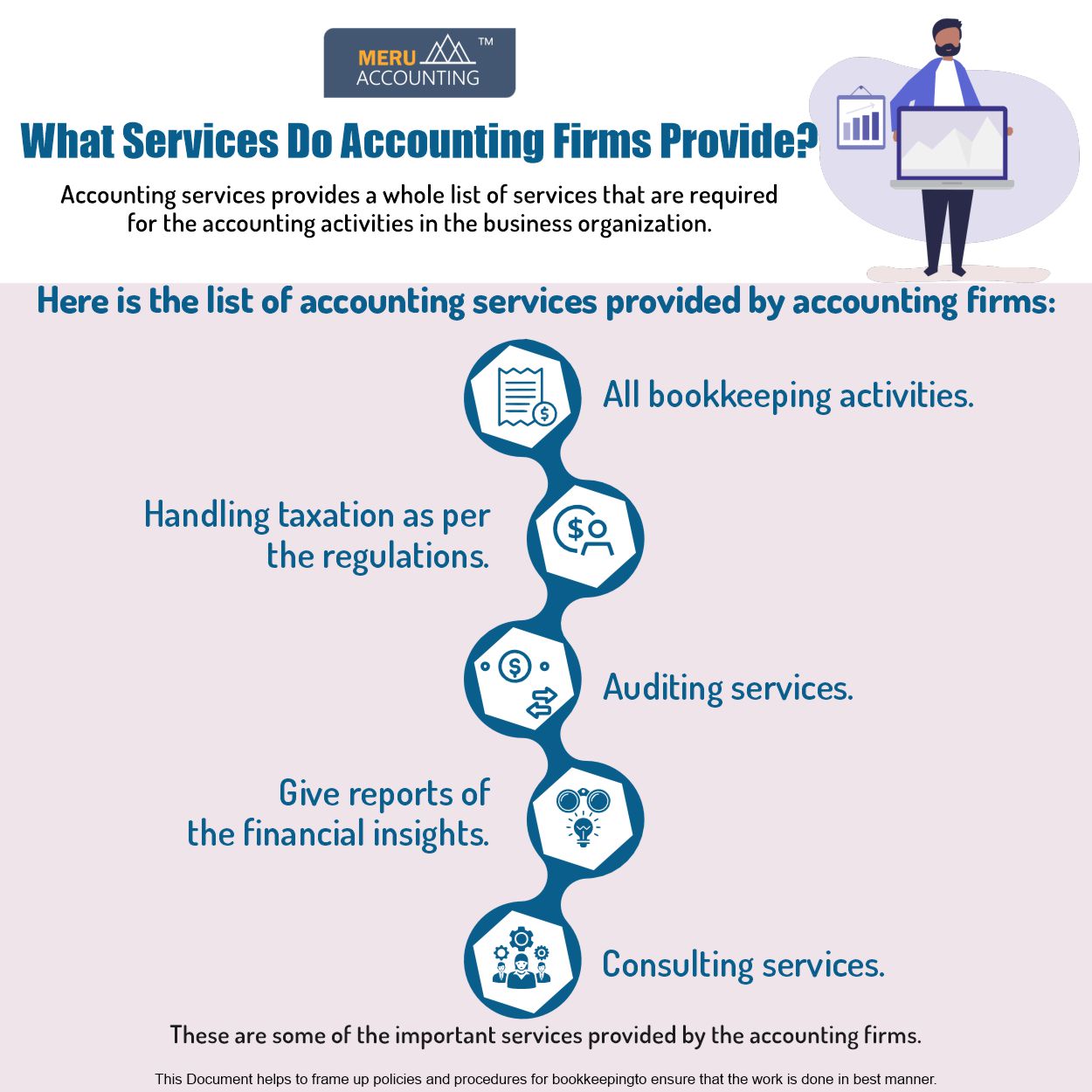

When people think about the accounting area, generally taxes come to mind (real estate bookkeeping OKC). And while a great deal of certified public accountant's and accountants do operate in tax obligation prep work or with income tax return, did you know there are several other kinds of accounting firms in the market? Accountancy entails a lot greater than simply taxesSimply like the name implies, a bookkeeping firm is a team of bookkeeping experts who offer tax resolution, bookkeeping, auditing and advising solutions (plus a variety of various other services) to paying clients. https://www.edocr.com/v/5qmxoaz5/ivanbowden73105/p3-accounting-llc. Certified public accountant's, or licensed public accountants, can operate at firms like these but not every accounting professional is a CPA but every certified public accountant is an accounting professional

CPA's need to stay on par with CPE (proceeding expert education and learning) credit histories as well to keep their license. There are various types of bookkeeping companies, including: Public Private Government 1. Full-Service Audit Firms Generally, a full-service accountancy firm gives a wide array of services from taxes to advising to audits, and more.

The 20-Second Trick For P3 Accounting Llc

These techniques have the sources necessary to provide a full collection of solutions, therefore the name full-service. 2. Tax Companies Tax Obligation Companies are a specialized form of bookkeeping companies which focus nearly exclusively on tax prep, preparation and resolution for services and people. Accounting professionals operating at these firms are usually CPAs and it's essential for them to stay up-to-date on tax laws.Accounting Firms Bookkeeping companies are focused on record-keeping and tracking income, expenditures, pay-roll and for some, tax returns for company customers. Which kind of accountancy firm do you operate at? Allow us understand in the comments listed below. Seeking to earn CPE or CE debts? Have a look at our complimentary course library below.

The Best Guide To P3 Accounting Llc

It is essential to have an accurate and reliable accountancy and financial reporting process to help you. The growth of an efficient solutions design called customer bookkeeping solutions offers automated modern technology and economical accountancy assistance to aid your service grow.Under CAS, a remote team of specialists (from a firm that supplies CAS) works as an essential component of your company and has a deeper understanding of your organization. Firms use client accountancy solutions in a number of varieties based upon your business demands. Some take care of only transactional solutions, while others assist you with all your accounting requires, consisting of transactional, compliance, performance, and strategic services.

Here are some of them. While most organization owners acknowledge the need for a skilled accountancy expert on their group, the expense of working with a full-time employee for financial reporting might not be possible for everybody. When you hire a staff member, you are not just paying wage and advantages like wellness insurance policy, retired life plans, and paid-off time but are additionally managing FICA, joblessness, and various other tax obligations.

A Biased View of P3 Accounting Llc

As your organization expands and your financial demands alter, a specialist client audit solutions copyright will change their solutions to satisfy your service needs and offer far better flexibility. Should read You might make most company choices based upon basic observations and reaction, yet having numbers on your side is a wonderful way to support your resolutions.

CAS accountants comprehend your firm in and out. https://allmyfaves.com/p3accounting?tab=P3%20Accounting%20LLC. They can additionally provide an individualistic viewpoint on accounting techniques and growth barriers and aid you make notified decisions to conquer them. One of the advantages of functioning with a company that uses client accounting solutions is access to the current audit software application, automation practices, and modern technology adjustments that can improve your business

Not known Details About P3 Accounting Llc

The group you deal with may be software professionals skillful in sophisticated software functions like Intuit Quick, Books, Microsoft Characteristics 365, Sage, or Net, Collection. Or, they may be generalists that can perform standard bookkeeping jobs on any kind of software program. Bookkeeping and accounting can derail your focus from what's more crucial to your company, specifically if it is not your favorite.A survey performed among 1,700 business that contract out accountancy revealed that CAS conserves time on overall company operations. With the ideal individuals, systems, and processes at hand, you can maximize resources, optimize revenues, manage investments, and produce organization growth models as successfully and quickly as possible. Should check out Unfortunately, fraudulence is one of the inescapable occurrences every business deals with.

Report this wiki page